block input tax malaysia list

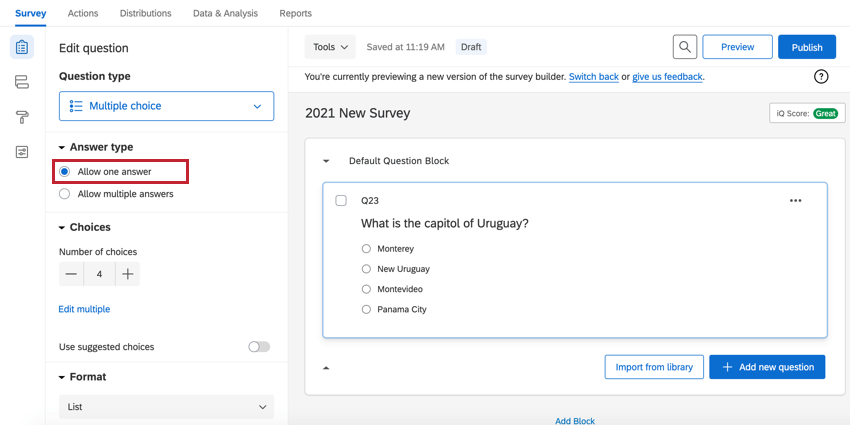

GUIDE ON INPUT TAX CREDIT As at 4 JANUARY 2017. But there are some cases where ITC is blocked so that recipient is not able to claim ITC.

Fiori App Library List Tutorial S 4hana Sap Blogs

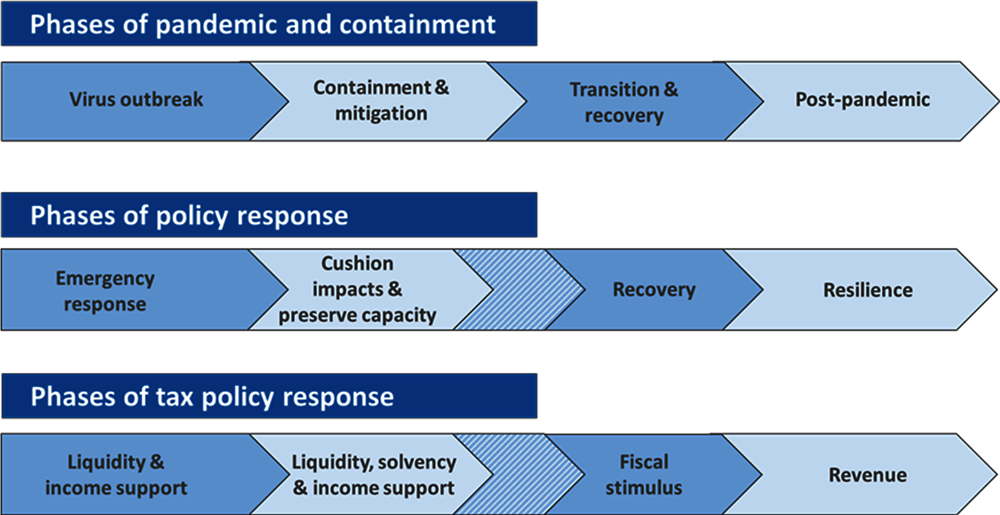

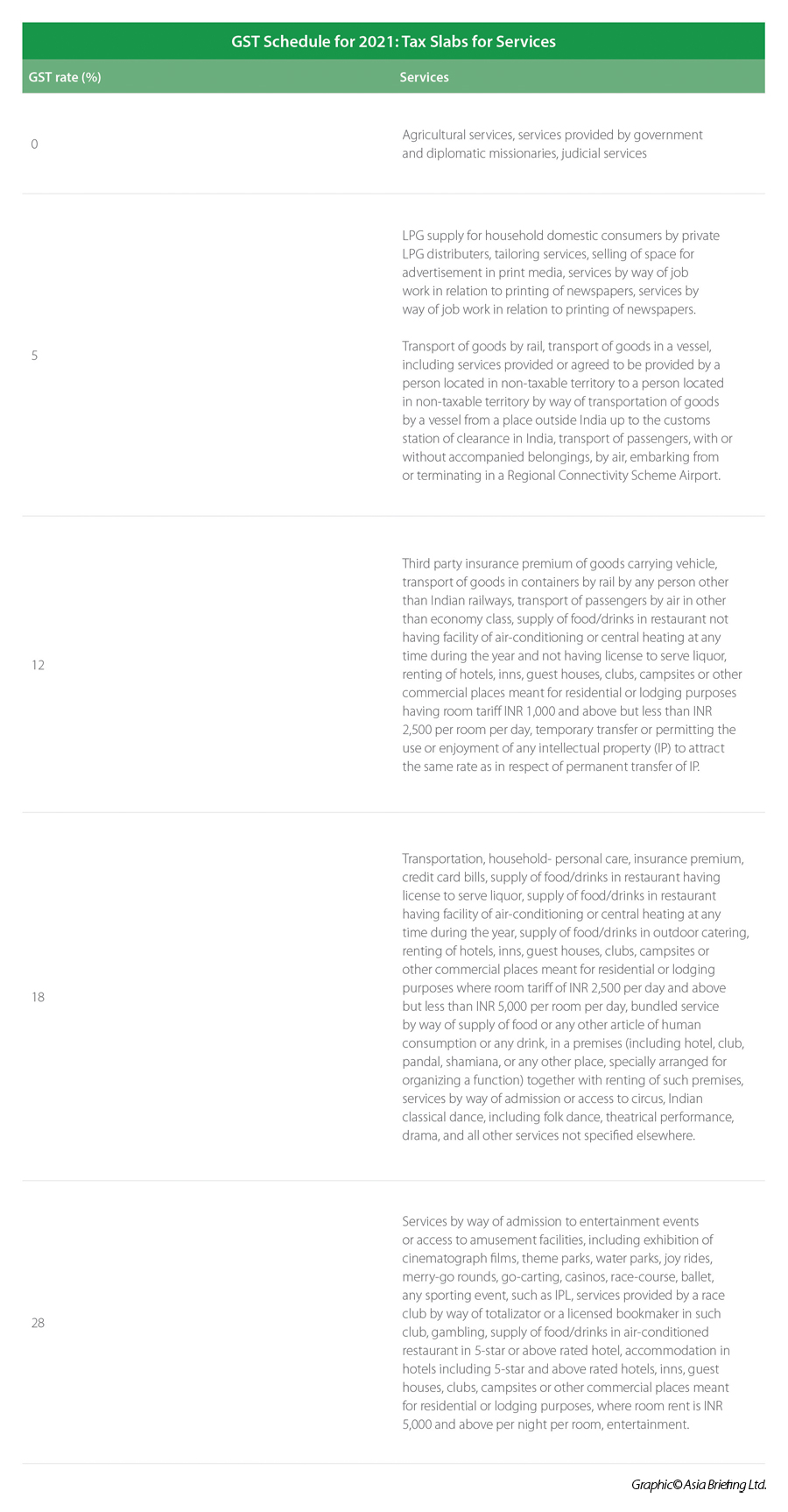

The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6.

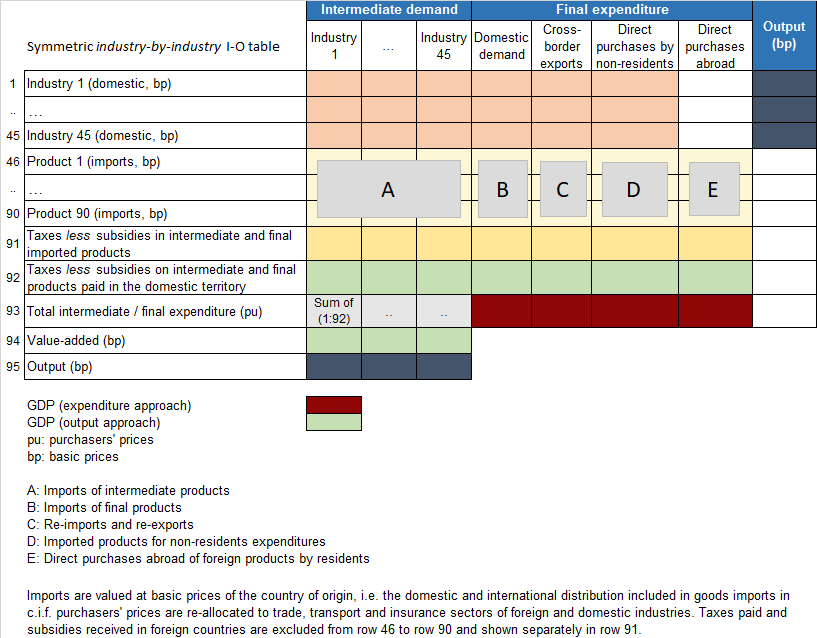

. At this point in time the rate may be slightly higher. Adjustment on input tax related to capital goods. Stamp atx 65 Specific tax on certain merchandise and services 66 Public lighting tax 67.

Adjustment on input tax as a result of annual adjustments. For GST Malaysia there are 3 types of supply. In order for the recipient to receive a package an additional amount of.

Activate GST Malaysia Tools Options General Goods Services Tax Enable Goods Services Tax. Examples of items that fall in this category include. In the taxable period of January 2016 ABC Islamic Bank incurred GST on the following.

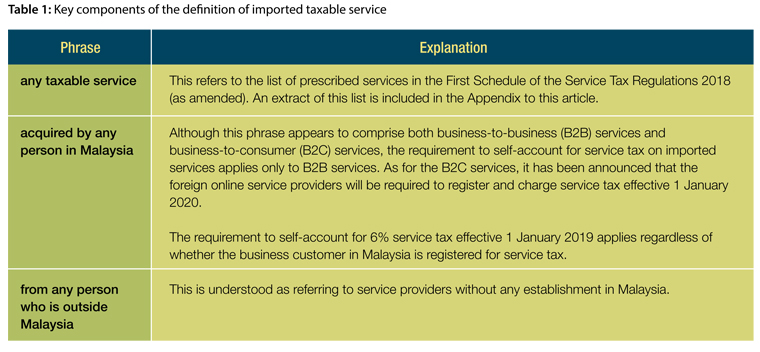

Except customs duty that applied previously ie. A What is Service Tax. A input tax on the purchase or acquisition of goods and services other than capital assets by a person if he is registered or liable to be registered under the Goods and Services Tax Act 2014 GSTA.

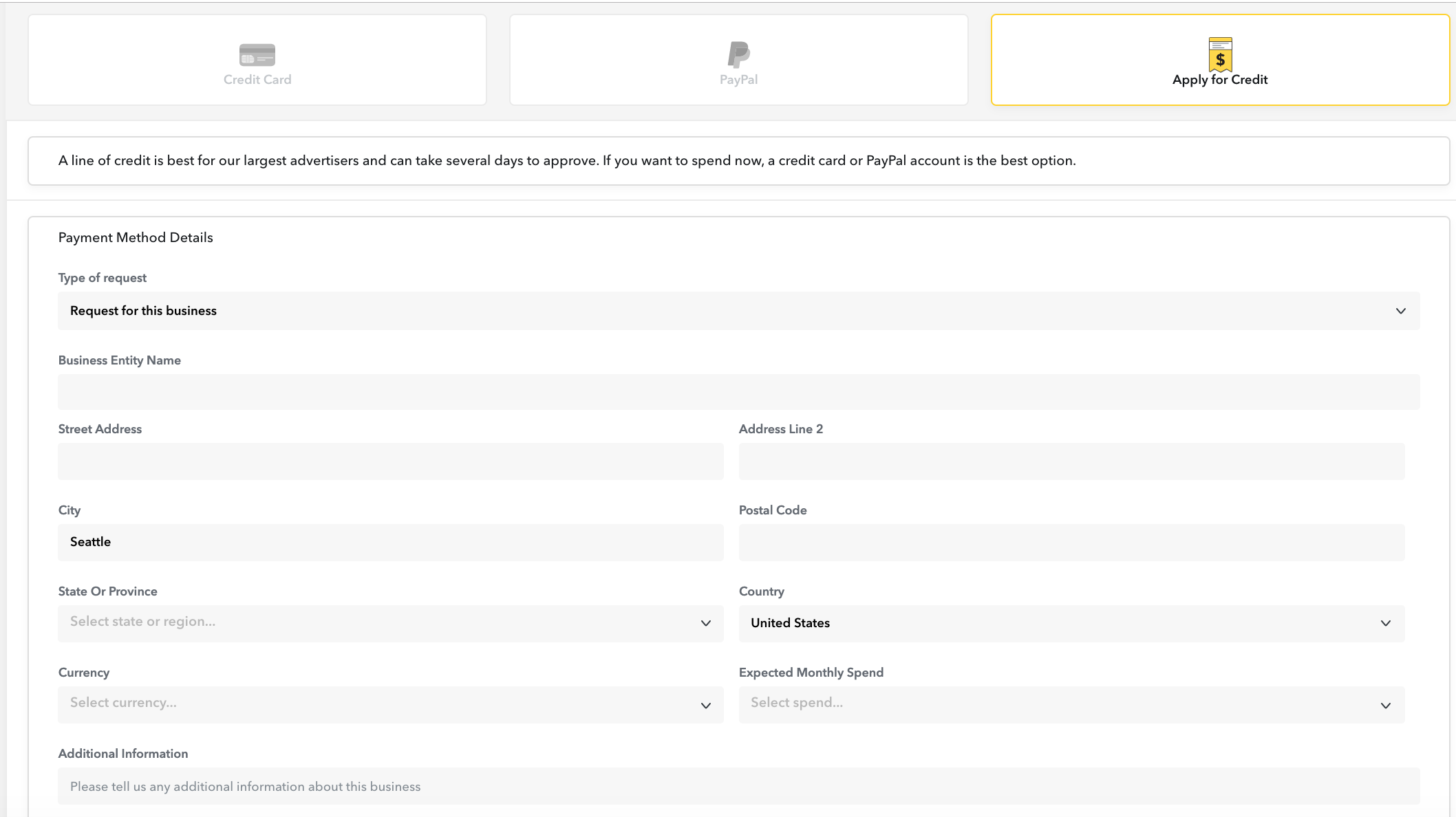

Malaysia GST - Blocked Input Tax. Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on all taxable goods. Accommodaoti n tax 68 Advance tax on dividend distribution 69 Import and export duties 70 Taxes on individuals 71 Personal.

Taxable service is any service which prescribed to be a taxable service. PROPOSED RATE OF GST IN MALAYSIA. 1 The supply to or importation by him of a passenger motor car.

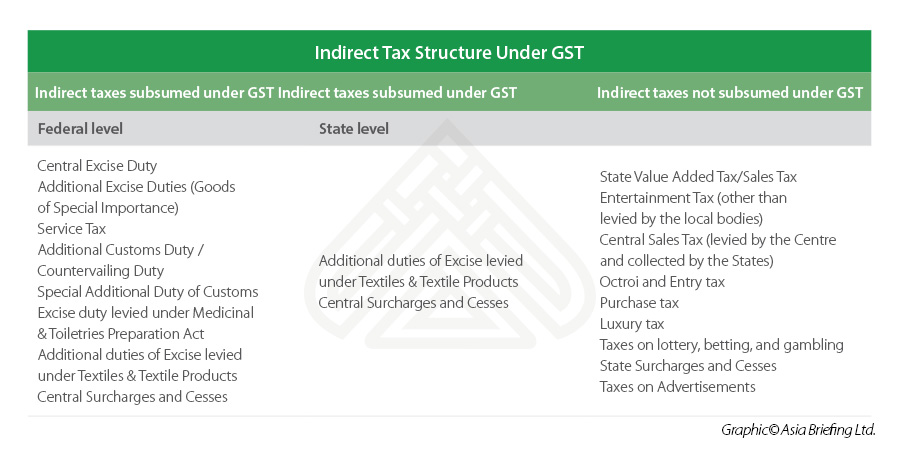

Central excise duty service tax VAT luxury tax etc. The indirect tax department has started blocking input tax credit of the whole supply chain under the GST framework if even one of the vendors or suppliers has missed out filing requirements impacting several corporates and prompting some to consider legal recourse. Block Input Tax Malaysia List - Income Tax Fundamentals 2017 with HR Block Premium.

Purchase of a passenger motor car. B input tax on standard rated supplies fee based services - RM 25000. GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns.

Claiming Input Tax in the Right Accounting Period You should only claim input tax in the accounting period corresponding to the date shown in the tax invoice or import permit. The Inland Revenue Board IRB has recently issuedPublic Ruling 12017 Income Tax Treatment of Goods and Services Tax GST Part 1 ExpensesPR 12017 andPublic Ruling 22017 Income Tax Treatment of GST Part 2 Qualifying Expenditure for Purposes of Capital AllowancesPR 22017. Input Tax 6 - Adjustment.

A list of No Input Tax Credit. The Tenant AllowBlock List allows a maximum of 500 entries for senders 500 entries for URLs 500 entries for file hashes and 1024 entries for spoofing spoofed senders. For Sales Tax goods other than petroleum products which are not exempted from Sales Tax or not prescribed to be subject to Sales Tax at the reduced rate of 5 percent.

There are goods and service or importation of goods may be denied to claim their credit. Supply or importation of passenger car including lease of passenger car Passenger car is defined as a motor car of a kind normally used on public roads which is constructed or adapted for the carriage of not more than nine passengers inclusive of the. Blocked input tax however means input tax credit that business cannot claim.

The available URL values are described in the URL syntax for the Tenant AllowBlock List section later in this article. For Service Tax all services which are in the specific scope of Service Tax. Input Tax 6 - Adjustment.

55 Block input VAT 60 Other taxes 61. 2 The supply of goods or services relating to repair maintenance and. The tax department is claiming that there could be circular trading or other frauds in many of.

Which would be taxable supplies if made in Malaysia. The import tax on a shipment will be. Imposition of Sales Tax 4.

A GST menu will be visible on the main menu bar. Property tax 62 Tax on unused land 63 Registration tax transfer tax stamp duty 46. The introduction of GST is part of the Governments tax reform program.

ITC being the backbone of GST and there are many condition to claim ITC on any items. PR 12017 provides an explanation on the basic concepts of GST. Hire of a passenger motor car.

If the full value of your items is over. Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. For example if the declared value of your items is.

It is further guided based on Regulation to prescribe on the items that are excluded. Section 175 of GST Act deals with the blocking of ITC on specified inward supplies. Blocked credit list Section 175 1.

Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia. Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. Alternatively you may claim input tax based on the date that you postprocess the tax invoice or import permit into your accounting system if you satisfy the qualifying conditions.

And b output tax on the sale of goods and services which is borne by a person if. Taxable person is any person who belongs in Malaysia and is prescribed to be a taxable person. The scope of Service Tax does not cover all services.

S38 12 GST Act. Adjustment on input tax as a result of other events. Check this checkbox to activate GST functions.

Repair maintenance and refurbishment of a passenger motor car. - We did not find results for. Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia.

Iii Malaysia - The new Sales Tax and Service Tax are effective from 1 August 2018 and replaces the Goods and Services Tax system. The maximum number of characters for each entry is. AutoCount Accounting Malaysia GST Hands-on Training Manual by Peter 5 2.

A input tax incurred on the acquisition of commodities for the purpose of Shariah financing - RM15000. Bhd a GST registered International Procurement Center undertakes procurement and sale. ITC is used for payment of output tax.

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Supported Composite Data Types For Electronic Reporting Formulas Finance Operations Dynamics 365 Microsoft Docs

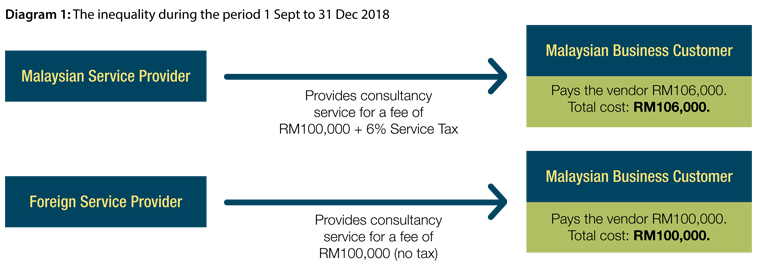

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

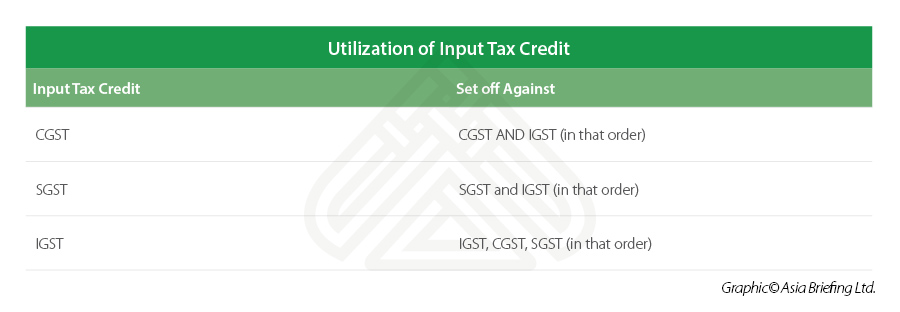

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

Fiori App Library List Tutorial S 4hana Sap Blogs

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

List Of Business Expenses On Which Input Vat Is Blocked

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Sap Query Browser List Of All Analytical Queries Views In S 4 Hana 2020 Sap Blogs

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News